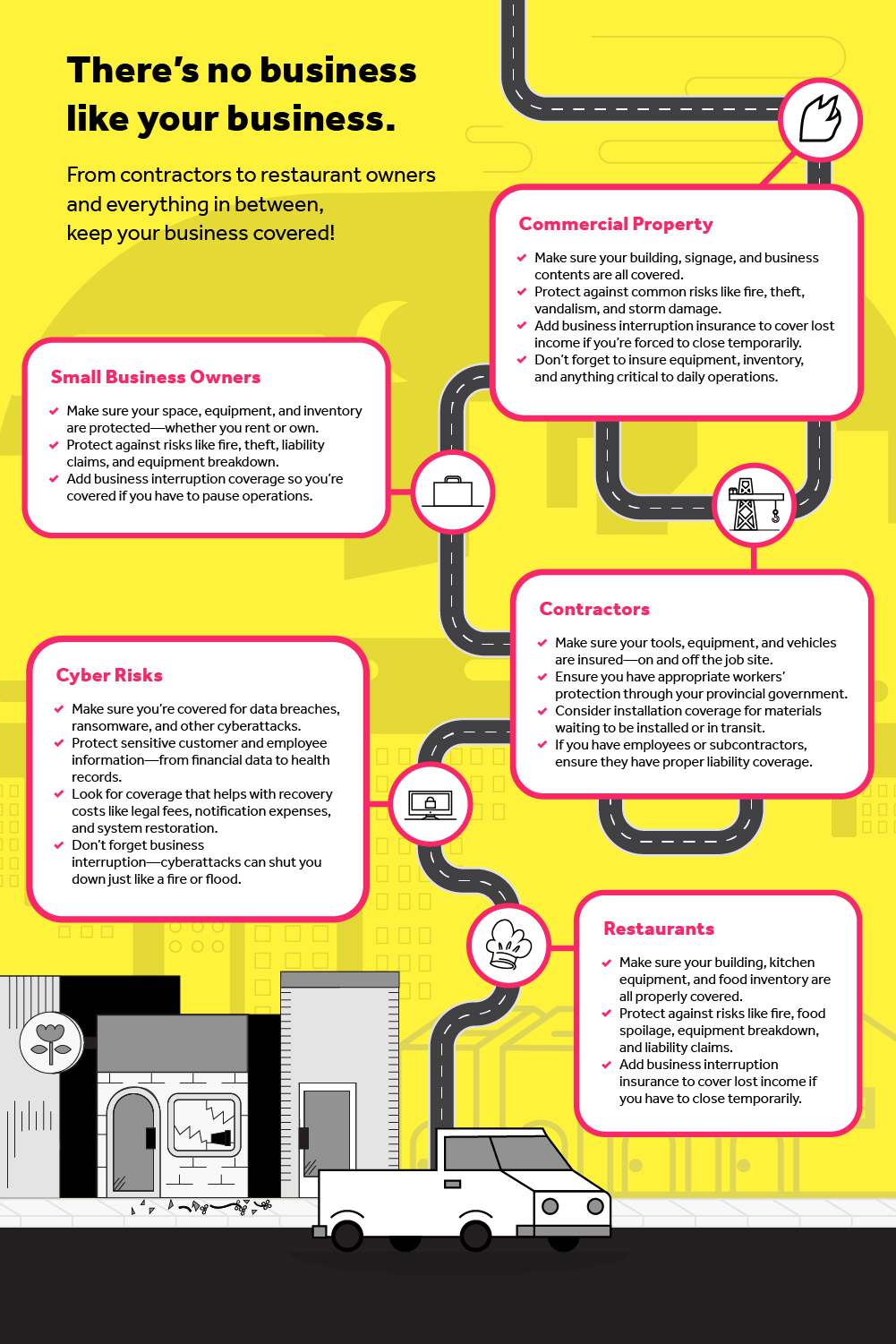

There’s no business like your business.

Summary

Reading Time

2 min

Commercial property:

- Make sure your building, signage, and business contents are all covered.

- Protect against common risks like fire, theft, vandalism, and storm damage.

- Add business interruption insurance to cover lost income if you’re forced to close temporarily.

- Don’t forget to insure equipment, inventory, and anything critical to daily operations.

Small business owners:

- Make sure your space, equipment, and inventory are protected—whether you rent or own.

- Protect against risks like fire, theft, liability claims, and equipment breakdown.

- Add business interruption coverage so you’re covered if you have to pause operations.

Contractors:

- Make sure your tools, equipment, and vehicles are insured—on and off the job site.

- Ensure you have appropriate workers’ protection through your provincial government.

- Consider installation coverage for materials waiting to be installed or in transit.

- If you have employees or subcontractors, ensure they have proper liability..

Cyber risks:

- Make sure you’re covered for data breaches, ransomware, and other cyberattacks.

- Protect sensitive customer and employee information—from financial data to health records.

- Look for coverage that helps with recovery costs like legal fees, notification expenses, and system restoration.

- Don’t forget business interruption—cyberattacks can shut you down just like a fire or flood.

Restaurants:

- Make sure your building, kitchen equipment, and food inventory are all properly covered.

- Protect against risks like fire, food spoilage, equipment breakdown, and liability claims.

- Add business interruption insurance to cover lost income if you have to close temporarily.

FAQ'S

Do I really need business interruption insurance if I already insure my building and equipment?

Absolutely! Property insurance repairs the damage — business interruption insurance helps repair your income. If you’re forced to close because of a fire, flood, cyberattack, or other covered loss, this coverage helps keep the lights on, pay bills, and retain staff while you rebuild. It’s like having a financial backup singer — it steps up when your business is temporarily offstage.

What types of businesses need cyber insurance?

If you store customer information, take payments, book appointments online, or even just use email — congratulations, you’re officially on a cybercriminal’s radar. Cyber insurance helps cover costs like legal fees, data recovery, customer notification, and downtime. Think of it as a digital guard dog that never sleeps.

I’m a contractor — isn’t insuring my tools enough?

Tools are just one piece of the puzzle. Between job-site risks, transportation, and liability from the work itself, having coverage for tools, equipment, installation materials, and your commercial vehicle keeps your operations protected from every angle. It’s not just insurance — it’s permission to take on bigger builds without biting your nails the whole time.