Introducing FarmSecure

Summary

Reading Time

5 min

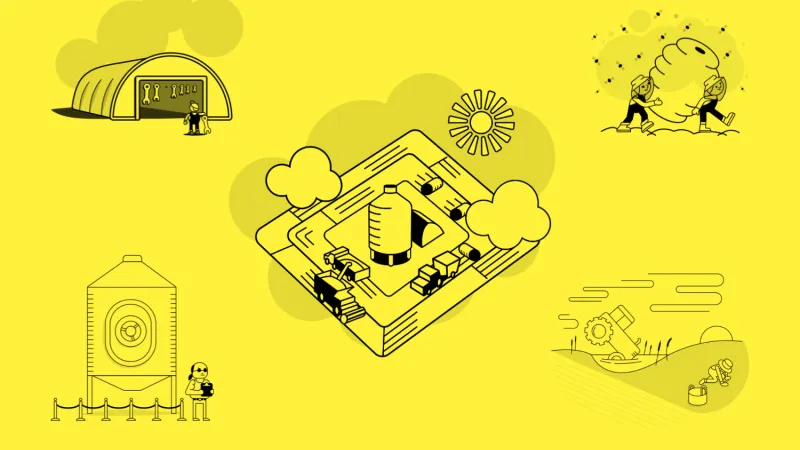

Eee iii eee iii insured! Did you hear? Sandbox’s farm insurance products got a fresh new look in July of 2023. With simplicity and meeting the changing needs of our insureds in mind, we were proud to redesign how we offer all our farm insurance products and coverages. Introducing FarmSecure, Sandbox Mutual Insurance’s farm insurance products are now available for purchase from a Sandbox insurance broker near you.

WHY DID SANDBOX CREATE THESE FARM BUNDLES AND BOXES?

ECONOMICAL.

Bundling and purchasing packages can offer rewards to policyholders, not only through discounts but also by allowing them to have additional coverage on something they may not have had previously—and with higher limits this time, too. With farm equipment becoming increasingly more digital and tech-y, they come with a rise in price. We are glad our new limits can attest to that inevitable fact!

FASTER.

Faster to bind, faster to quote. It’s sometimes as simple as that. This was one of the driving forces behind the change, too. Our farm insurance packages and boxes simplify the decision-making process because they reduce the amount of data input that is required, which ultimately shortens quoting and the overall process for our brokers, underwriters, and policyholders.

SMART COVERAGE.

It prevents comparisons. We do this by bundling insurance coverages, ensuring that our policyholders have comprehensive coverage with fewer gaps and overlaps, and simplifying the overall insurance process so you don't have to compare liability and policies from various providers. We do this with our three boxes, the Farm Business Box, the Farm Lifestyle Box for hobby farms, and the Buzz Box for beekeepers.

Last but not least, it’s SIMPLE.

With a FarmSecure package or box, our policyholders can now have a single payment, a single renewal date, and only need one insurance provider, making the management of their insurance policies easier and more secure. Summing up why we call it, FarmSecure.

Let’s get into each of the packages and boxes now. What’s the difference? What’s in each of them? What do they do?

PACKAGES

Property Protection—what is it?

As a new expansion of our previous endorsement known as FP101 Rider, Property Protection’s blanket limit coverage accounts for:

- Farm Tools

- Contents of Outbuildings

- Miscellaneous Farm Property and Equipment, including Tack

- Fire Department Charges

- Debris Removal

We’ll protect the stuff, you reap the harvest.

What is Production Protection?

Sure, you’ve insured the big things. But what about the little ones? Insuring your prairie gold is crucial, and you can do it with our Production Protection if you input or output:

- Grain

- Fodder

- Produce

- Silage

- Fertilizer/Chemicals

- Fuel

So, why not protect the little things that keep the big things running?

How does Equipment Protection work?

Remember the good ol' days when farmers didn’t have big, expensive equipment and had to do it all by hand? Yeah, neither do we. Let’s keep it that way. Your farm equipment is critical to your success and efficiency, and choosing our Equipment Protection provides blanket limit coverage for:

- Harvesting Machinery

- Non-Harvesting Machinery

- Temporary Replacement Machinery

- All-Terrain Vehicles for Farm Use

- Loss of Use with a $5,000 limit

BOXES

What does the Farm Business Box cover?

Go on. Put all those eggs in one basket with the Farm Business Box! If you are actively farming over 160 acres of land for grain, livestock, and/or mixed farming operations, you are eligible!

Farm Lifestyle Box: What’s in it?

Sure, it’s called a “hobby” farm. But we both know it’s more than that. The Farm Lifestyle Box, our version of a Hobby Box, is ideal for hobby farms located outside of town limits where livestock and produce are primarily used for personal consumption.

- Farmer's Comprehensive Liability of $2,000,000

- Property Protection: $50,000

- Production Protection, including Lifestyle Livestock Endorsement Extension: $25,000

- Equipment Protection: $50,000

- Farm Policy Enhancement Endorsement

What does the Buzz Box entail?

We’re glad you asked! For leafcutter and/or honey beekeepers who do not own a farm or who beekeep in conjunction with their farm operations, this box is for you:

- Farmer’s Comprehensive Liability of $2,000,000

- Beekeeping equipment

- Nesting boards and shelters

- Adult bees and cocoons

- Hives, including bees and raw honey

- Stock of honey

With the Buzz Box, policyholders have the option to increase the included limits to tailor them to their needs. Plus, 10% of the direct written premium on this box will be donated to Pollinator Partnership Canada —now that’s something to buzz about!

How can I learn more?

Phew! It does look like a lot of information upfront, but at Sandbox, we make things simple. You can find all our boxes and packages in an easy-to-understand format on our website with helpful articles, resources, and more. You can even filter coverages by province, whether it’s farm insurance in Manitoba, Saskatchewan, or Alberta you’re looking for. If you’re looking to inquire about a FarmSecure policy, get a quote from a Sandbox Mutual Insurance broker. You can find the closest Sandbox broker to you by using our virtual broker map.

Please note that the information in this article may not accurately reflect your insurance policy from Sandbox Mutual Insurance or another insurance company. Please refer to your policy or talk to your broker about your specific coverages.

FAQ'S

What’s the difference between a FarmSecure package and a FarmSecure box?

Great question! Packages are all about protecting what you own — tools, outbuildings, equipment, your grain and fuel — the everyday essentials that keep your operation moving. Boxes, on the other hand, bundle big-picture coverages like liability, property, production, and equipment into one easy policy designed for how you farm… whether that’s as a full-time producer, a hobby farmer, or a beekeeper with big buzz-ness goals. Packages fill the gaps, boxes make life simple!

Do FarmSecure boxes include liability coverage?

They sure do! Liability is the crown jewel of every FarmSecure box. Whether you’re running over 160 acres or just raising a few animals for your own table, each box includes $2,000,000 in Farmer’s Comprehensive Liability — because accidents happen faster than a cow can jump a fence.

How do I know which FarmSecure option is right for me?

Start with how you farm:

- Actively farming? → Farm Business Box

- Hobby farming for personal use? → Farm Lifestyle Box

- Keeping bees (with or without a farm)? → Buzz Box

- Your Sandbox broker will help match your operation to the right fit — no guessing games, no complicated comparison charts, just delightfully simple coverage.