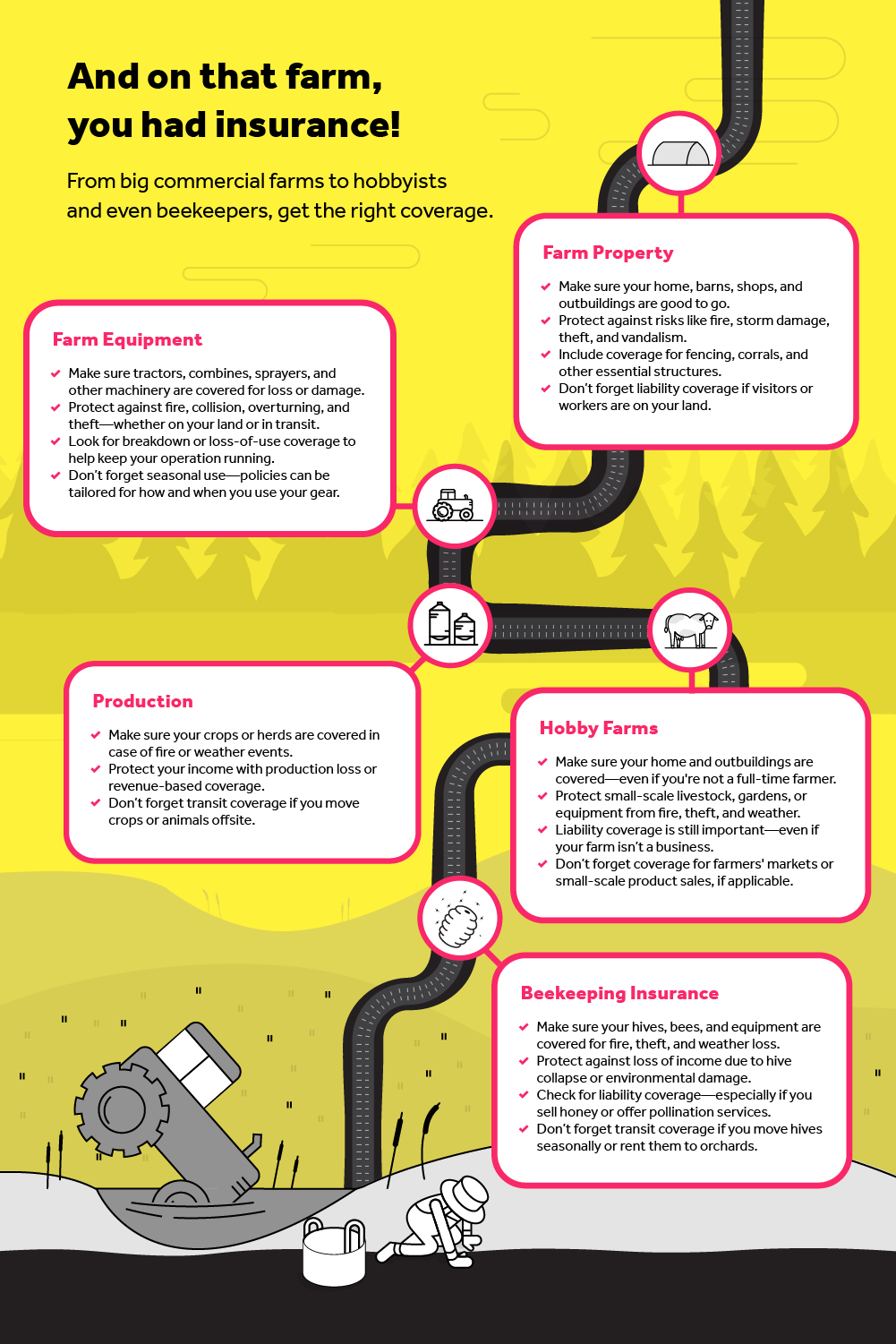

And on that farm, you had insurance!

Summary

Reading Time

2 min

Farm property:

- Make sure your home, barns, shops, and outbuildings are good to go.

- Protect against risks like fire, storm damage, theft, and vandalism.

- Include coverage for fencing, corrals, and other essential structures.

- Don’t forget liability coverage if visitors or workers are on your land.

Farm equipment:

- Make sure tractors, combines, sprayers, and other machinery are covered for loss or damage.

- Protect against fire, collision, overturning, and theft—whether on your land or in transit.

- Look for breakdown or loss-of-use coverage to help keep your operation running.

- Don’t forget seasonal use—policies can be tailored for how and when you use your gear.

Production:

- Make sure your crops or herds are covered in case of fire or weather events.

- Protect your income with production loss or revenue-based coverage.

- Don’t forget transit coverage if you move crops or animals offsite.

Hobby farms:

- Make sure your home and outbuildings are covered—even if you're not a full-time farmer.

- Protect small-scale livestock, gardens, or equipment from fire, theft, and weather.

- Liability coverage is still important—even if your farm isn’t a business.

- Don’t forget coverage for farmers' markets or small-scale product sales, if applicable.

Beekeeping insurance:

- Make sure your hives, bees, and equipment are covered for fire, theft, and weather loss.

- Protect against loss of income due to hive collapse or environmental damage.

- Check for liability coverage—especially if you sell honey or offer pollination services.

- Don’t forget transit coverage if you move hives seasonally or rent them to orchards.

FAQ'S

Do I really need separate coverage for my farm equipment if I already insure my buildings?

Yes! Your barn might be the home base, but your tractors, combines, and sprayers do the heavy lifting. Equipment coverage protects your machines from fire, collision, overturning, and theft — even when they’re out working in the field or being hauled between locations. Buildings shelter your gear… but insurance protects it.

What if I’m raising a few chickens and growing veggies — do I still count as a “farm”?

Totally. A hobby farm is still a farm in the eyes of Mother Nature… and insurance. Even small-scale operations can face losses from weather, theft, or liability if someone wanders onto the property. Hobby farm coverage keeps your lifestyle fun — not financially stressful.

I’m a beekeeper — do I really need my own kind of insurance?

Bees may be small, but the risks (and the honey) add up. Specialized beekeeping coverage protects your hives, honey stock, and equipment — plus offers protection if you sell honey or rent hives. It’s buzz-worthy peace of mind for beekeepers of all sizes.