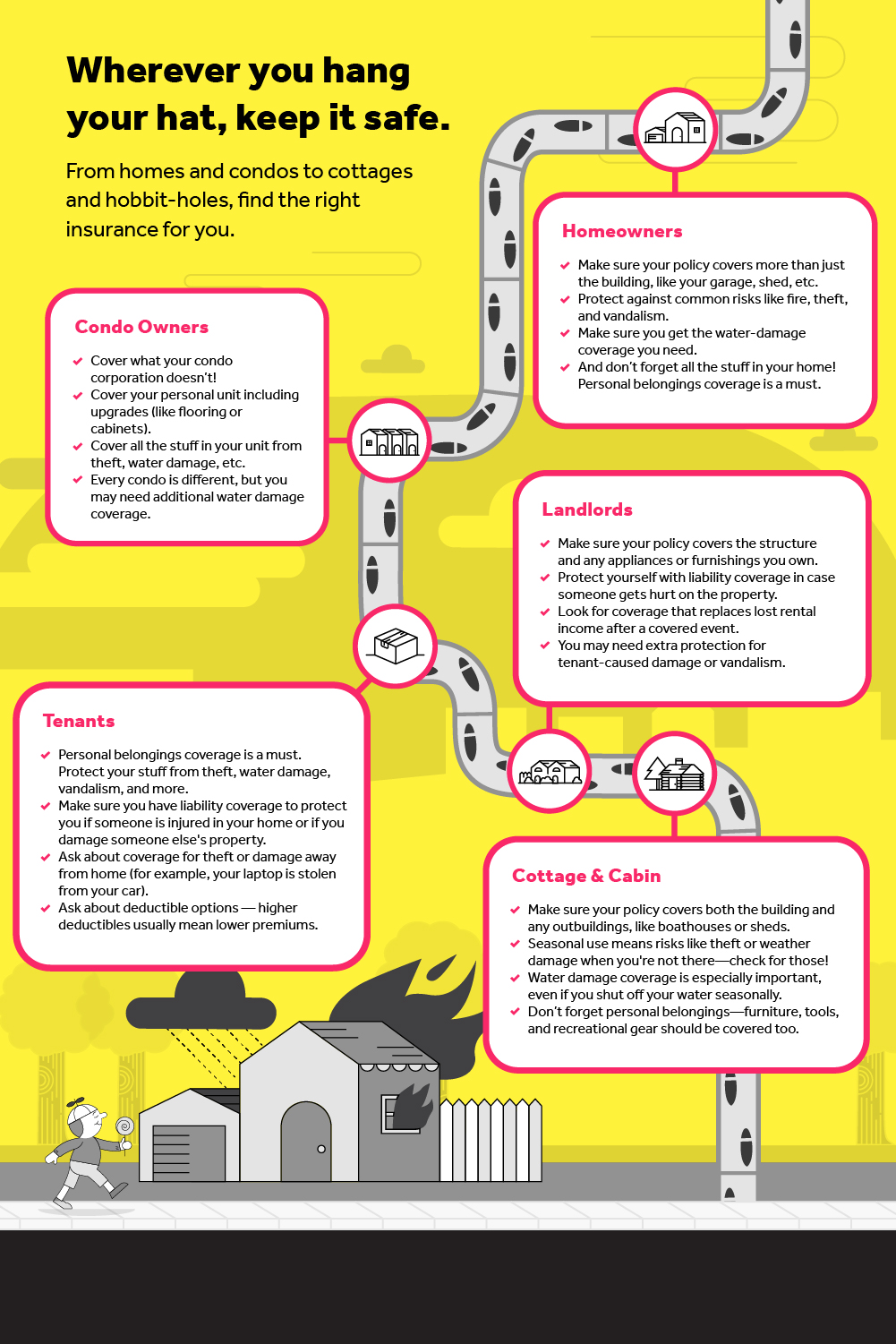

Wherever you hang your hat, keep it safe.

Summary

Reading Time

2 min

Homeowners:

- Make sure your policy covers more than just the building, like your garage, shed, etc.

- Protect against common risks like fire, theft, and vandalism.

- Make sure you get the water-damage coverage you need.

- And don’t forget all the stuff in your home! Personal belongings coverage is a must.

Condo owners:

- Cover what your condo corporation doesn’t!

- Cover your personal unit including upgrades (like flooring or cabinets).

- Cover all the stuff in your unit from theft, water damage, etc.

- Every condo is different, but you may need additional water damage coverage.

Tenants:

- Personal belongings coverage is a must. Protect your stuff from theft, water damage, vandalism, and more.

- Make sure you have liability coverage to protect you if someone is injured in your home or if you damage someone else's property.

- Ask about coverage for theft or damage away from home (for example, your laptop is stolen from your car).

- Ask about deductible options — higher deductibles usually mean lower premiums.

Landlords:

- Make sure your policy covers the structure and any appliances or furnishings you own.

- Protect yourself with liability coverage in case someone gets hurt on the property.

- Look for coverage that replaces lost rental income after a covered event.

- You may need extra protection for tenant-caused damage or vandalism.

Cottage & Cabin:

- Make sure your policy covers both the building and any outbuildings, like boathouses or sheds.

- Seasonal use means risks like theft or weather damage when you're not there—check for those!

- Water damage coverage is especially important, even if you shut off your water seasonally.

- Don’t forget personal belongings—furniture, tools, and recreational gear should be covered too.

FAQ'S

Do I really need extra coverage if I already have the basics?

Basic coverage is like bringing only a toothbrush on vacation — technically, you can survive, but it’s not ideal. Each type of property (home, condo, rental, cabin) comes with different risks, so the right add-ons ensure things like water damage, detached buildings, and belongings are properly protected. Tailoring your policy means fewer surprises and more peace of mind.

What’s the difference between belongings coverage and building coverage?

Think of it this way: building coverage protects the structure — walls, roof, attached fixtures — while belongings coverage protects everything that makes your space yours: furniture, electronics, clothing, even that paddleboard waiting patiently for summer. Both matter, because a house isn’t really a home without what’s in it.

How do I know what coverage I need for where I live?

Start by looking at your lifestyle and location: Do you live in a condo tower? Rent a basement suite? Escape to a cabin on weekends? Each comes with unique risks (such as seasonal theft at the lake or gaps in the condo corporation). A broker can help you pinpoint what applies to your property so you’re covered from roof to rec room and everywhere in between.