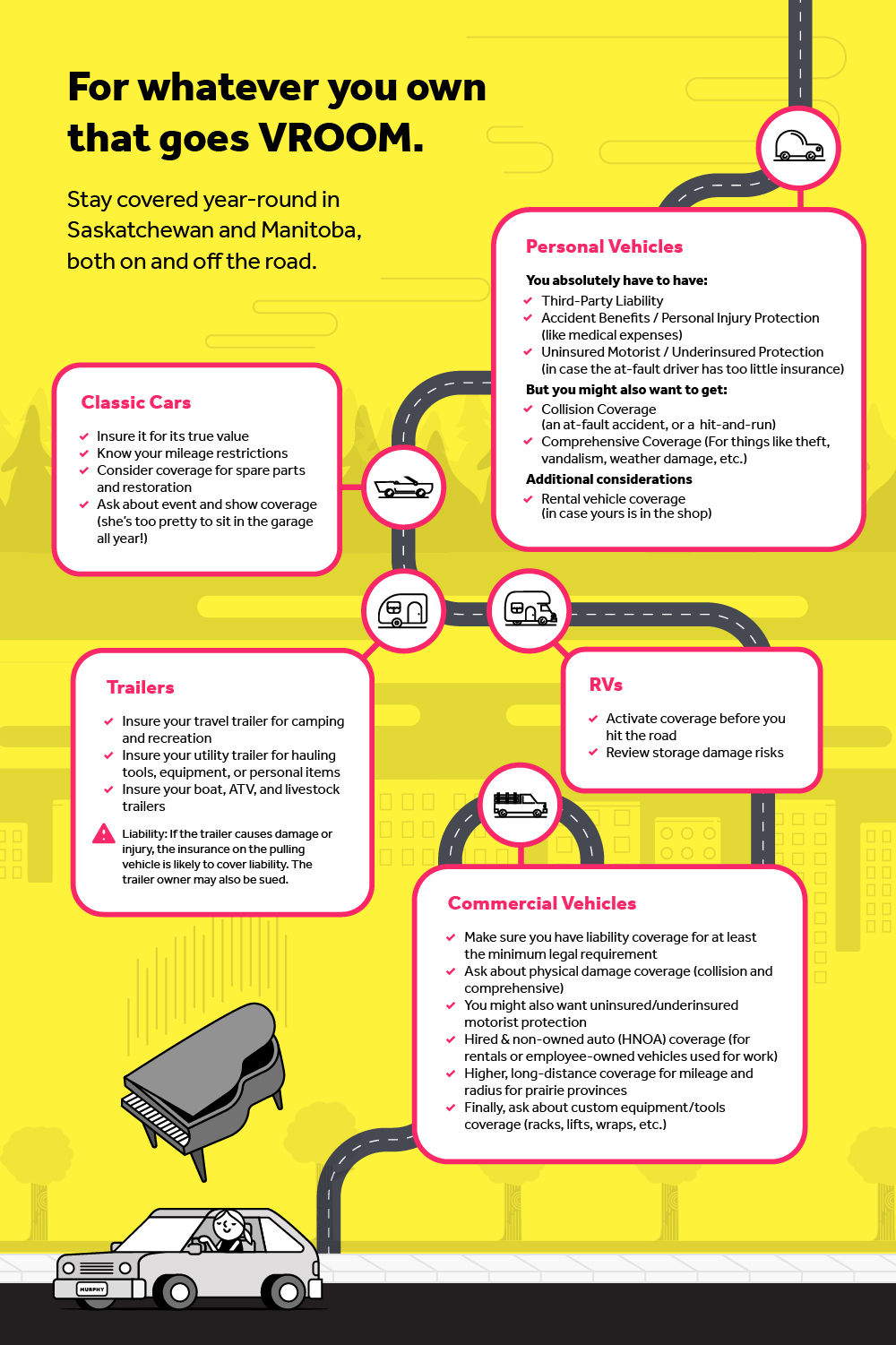

For whatever you own that goes VROOM.

Summary

Reading Time

2 min

Personal vehicles:

- You absolutely have to have:

- Third-Party Liability

- Accident Benefits / Personal Injury Protection (like medical expenses)

- Uninsured Motorist / Underinsured Protection (in case the at-fault driver has too little insurance)

- But you might also want to get:

- Collision Coverage (an at-fault accident, or a hit-and-run)

- Comprehensive Coverage (For things like theft, vandalism, weather damage, etc.)

- Additional considerations

- Rental vehicle coverage (in case yours is in the shop)

RVs:

- Activate coverage before you hit the road

- Review storage damage risks

Classic cars:

- Insure it for its true value

- Know your mileage restrictions

- Consider coverage for spare parts and restoration

- Ask about event and show coverage (she’s too pretty to sit in the garage all year!)

Trailer:

Insure your travel trailer for camping and recreation

Insure your utility trailer for hauling tools, equipment or personal items

- Insure your boat trailer

- Insure your ATV trailer

- Insure your livestock trailer

Liability: If the trailer causes damage or injury, the insurance on the pulling vehicle is likely to cover liability. The trailer owner may also be sued.

Commercial vehicles:

- Make sure you have liability coverage for at least the minimum legal requirement.

- Ask about physical damage coverage (collision and comprehensive).

- You might also want uninsured/underinsured motorist protection.

- Hired & non-owned auto (HNOA) coverage (for rentals or employee-owned vehicles used for work).

- Higher, long-distance converge for mileage and radius for prairie provinces

- Finally, ask about custom equipment/tools coverage (racks, lifts, wraps, etc.).

FAQ'S

Do I really need more than basic, mandatory auto insurance?

Short answer: probably! Mandatory insurance covers injuries you cause and damage to others — but not your own prized set of wheels. Collision and comprehensive help repair or replace your vehicle after bumps, break-ins, hailstorms, deer-crossings, and other “well… that happened” moments. More coverage means more peace of mind every time you turn the key.

What’s the difference between insuring my regular car and my RV, motorcycle, or trailer?

Your everyday vehicle is built for daily errands. Your RV, snowmobile, motorcycle, or specialized trailer? Not so much. They each come with unique risks, seasonal use, and different rules when they’re in motion vs. in storage. Tailored coverage ensures you’re protected whether you’re camping, cruising, hauling gear, or carving fresh trails.

How do I know if I need extra coverage like rental protection or coverage for custom parts?

Ask yourself: “If my vehicle took an unexpected vacation in the repair shop, would I be stranded?” Rental coverage keeps life moving. And if you’ve added custom racks, upgraded parts, or a show-and-shine–ready paint job, those extras should be protected too. A broker can help customize your policy so you’re only paying for what you actually need — not a one-size-fits-all solution.