What Is Loss Control, and How Does It Benefit My Home, Farm, or Business?

Summary

Reading Time

7 min

In risk management, loss control aims to reduce the probability of losses occurring or to minimize the damage, if one were to occur.

HOW DOES IT WORK?

What is loss control? Who needs it? How does it benefit my home, farm, or business? These are often the questions that loss control experts receive or some of the general confusion surrounding the topic in the insurance industry. As more insurance companies and providers move toward offering loss control assessments and analyses in-house, here are the things you should know about it—or rather, the things you might be missing out on.

WHAT IS LOSS CONTROL?

In risk management, loss control aims to reduce the probability of losses occurring or to minimize the damage, if one were to occur. Businesses underestimate the power a loss control assessment can have and keeping a consultant under their wing. When it comes to the evaluation of risks and keeping your customers, family members, and employees safe, you can never be too cautious. Loss control consultants are exceptional because they’re hands-on, they come right to you and assess your property through their eyes. They are up-to-date on all inspection techniques and have the latest inspection tools, too. Face it, when you’re seeing the exact same place every day, potential losses don’t quite stand out to you like they do to them. And trust us when we say that potential losses stick out to them like a sore thumb!

WHAT ARE THE BENEFITS OF HAVING A LOSS CONTROL ASSESSMENT OR CONSULTATION FOR YOUR PROPERTY?

Loss control has many advantages when it comes to preventing losses in your home, farm, or business. Take it from Justin Guillaume, Sandbox’s Supervisor, Loss Control:

Our goal in loss control is to reduce losses,” says Justin Guillaume. “By learning more about your property and the deficiencies that may exist, you’re more likely to have less losses. Every loss will result in saved money as you will not be paying a deductible for the losses where a claim is made, and you won’t be paying for the smaller losses where a claim would not be made.”

Guillame further states, “There is also the preventative maintenance portion as well. If scheduled maintenance is performed properly, there will need to be less frequent replacement of building components and mechanical systems.

Simple enough. So, without further ado, here are our top six benefits:

1. Reducing claims

One benefit is being made aware of deficiencies on your property or business operations that could lead to a loss. This not only saves you the hassle of having a claim and processing one but also any legal disputes and settlements. These come at a hefty price and require time and energy. Ultimately, it's like having a preventive maintenance program for your business, home, or farm, keeping things smooth and costs down.

2. Lowering premiums

By reducing the number and severity of claims, the amount of premium that needs to be charged can be reduced. Secondly, if your insurance company is made aware of potential risks associated with your property, and they are few and far-between, it can be easier to acquire insurance, also lowering the premium. So simply, fewer headaches and more money in your pocket!

3. Better underwriting

By having a loss control consultation or assessment administered on your home, farm, or business, it provides our underwriters and brokers with the information needed to ensure your insurance policy is accurate and adequately covering your needs. You wouldn’t want to miss anything, and with loss control experts on your side, you won’t!

4. Knowledge of emergency procedures

Being able to plan guidelines or determine restricted areas accordingly after the loss control assessment can keep everyone safe in the case of a fire or other emergency. We’re talking about emergency exits, evacuation plans, potential fire hazards in the area, procedures and safe places for harsh weather conditions and natural disasters, and more!

5. Advanced technology

5. Advanced technology

When you have a loss control specialist conduct assessments at your business, farm, or property, they can use advanced technology that may not be available to you. For example, right now there are a lot of different building monitoring devices being created for electrical and plumbing systems. In the future, we predict that these devices will become just as common on properties as cameras and alarm systems are now. These new devices can accurately shut off water when a leak is detected in an appliance or water line, monitor the electrical system for temperature variations and provide maintenance alerts, and even take preventative action if an arc is detected.

6. Learn from it

A loss control assessment can provide opportunities and loss prevention ideas on how you can improve your home, farm, or business to make it safe and more efficient for everyone. And you might learn a thing or two about stuff on your property that you didn’t before.

HOW TO PREPARE FOR A LOSS CONTROL CONSULTATION

If you have booked a loss control consultation with a loss control specialist, the biggest recommendation we can give is to mark your date and time in your calendar and be on time. Oftentimes, these loss control specialists are doing a certain route to be time-efficient and have multiple insured appointments in the same day. It’s the simplest thing to keep things running smoothly.

Next, be familiar with any updates and renovations that have been made to the building. This will be some of the questions loss control specialists will be inquiring about, so having this information and being knowledgeable about the building’s history can help speed up the process.

Lastly, don’t be afraid to ask questions. We want the information to be straight-to-the-point and you to understand any risks or potential losses in your home, farm, or business. Understanding the losses that could occur can help you make informed decisions on preventative actions.

HOW DOES LOSS CONTROL WORK AT SANDBOX?

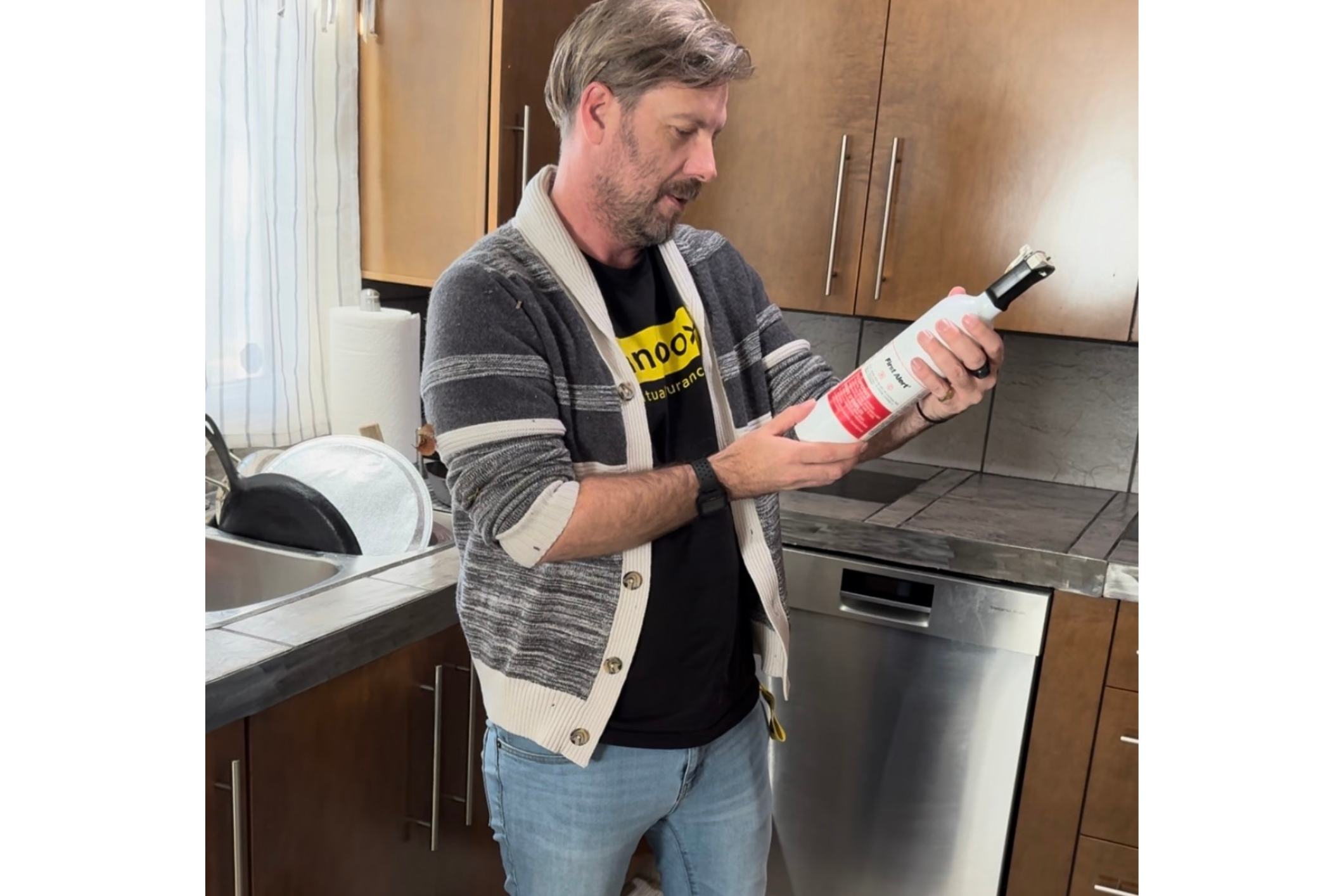

A designated Loss Control Consultant will gather the necessary information provided by our underwriters and contact your broker to let them know we plan on performing an assessment on your property so they can have a conversation with you before we arrange a time for the Loss Control Consultant to evaluate the property and offer their recommendations. This on-site assessment involves taking measurements, noting heating, insulation and mechanical deficiencies, capturing photos and conducting thermal imaging scans to detect hidden water leaks, and make notes of deficiencies or hazards that may lead to potential losses in the future. Our Loss Control Consultants also use gas monitoring technology to detect natural gas and carbon monoxide leaks in and around the building.

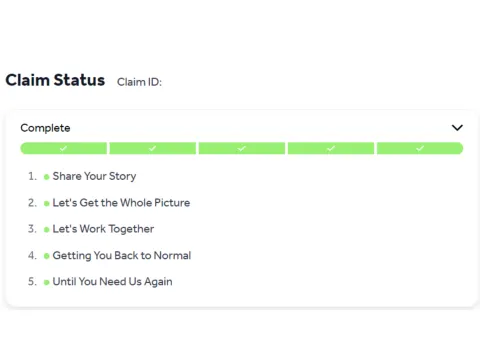

The latest addition to the Sandbox loss control team is Scout. Scout is an on-line platform designed by our very own consultants using their knowledge and experience to help them record detailed and accurate information in real time when they come to visit your home or workplace. Once we gather all the necessary information on-site, Scout will generate a report to send out to our underwriters. Our team will work to provide you with recommendations on how to improve your property, your operations, and reduce losses.

This is why having one of our specialists conduct an assessment is beneficial to you: we’ll dig deeper and look beyond the surface. We don’t want to just tell you what you must do, but help educate our valued customers and ultimately, reduce losses.

These are only a few of the ways loss control is advantageous to your farm, business, or home, there’s so much more to it, but we’ll spare you those nitty-gritty details. After all, we want you to focus on running your farm or business and keeping your family safe, so leave the complex stuff to us. It’s why there’s simply no downside to having a loss control assessment administered for your property, whether you’re a first-time or experienced homebuyer, business owner, or maybe haven’t done it for a few years. If you have an insurance policy with Sandbox or in the works of getting one, be sure to ask your broker about loss control measures or contact the Sandbox Mutual Insurance team to learn more about how we’re making waves in the loss control industry!

Please note that the information in this article may not accurately reflect your insurance policy from Sandbox Mutual Insurance or another insurance company. Please refer to your policy or talk to your broker about your specific coverages.

FAQ'S

What exactly is loss control, and why would I need it?

Think of loss control as a preventive superpower. Instead of waiting for something to go wrong, a loss control expert visits your home, farm, or business to spot hazards you may not notice. The goal? Reduce the risk of accidents, minimize damage if a loss occurs, and save you from unnecessary deductibles, repairs, and downtime.

How does a loss control assessment actually work?

Once scheduled, a Sandbox Loss Control Consultant comes on-site to assess your building or operations. They’ll take measurements, photos, and use helpful tech like thermal imaging and gas detection. After the assessment, you’ll receive recommendations on what to fix, update, or monitor — all designed to keep your space safer and running smoothly.

Does loss control affect my insurance premium?

It sure can — in the best way. Fewer losses mean fewer claims… and that can help support lower premiums over time. Plus, if your property is well-maintained and shows low risk, it can be easier for underwriters to insure you competitively—safety for the win and savings for the wallet.